Qslob Basics

Posted : admin On 8/2/2022CONTRIBUTION AND ALLOCATION LIMITATIONS FOR PLAN YEARS ENDING IN 2009

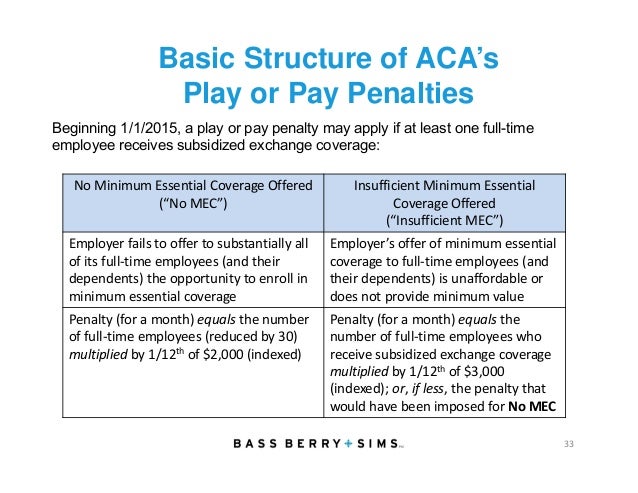

NOTICE OF CHANGE FOR SEMINAR REGISTRATIONS: To register for Relius Education seminars and conferences, please login or register for a new login account before proceeding. For more information, please see the Benefits of a Relius User Login Account.For assistance, please contact Client Services at 800-326-7235, and select Option 6. Employer Mandate—Basic Rules On-Going Full Time Employees — if employee determined to be full-time employee during Standard Measurement Period must be offered health care coverage during related Stability Period –If hours change during Stability Period (i.e. Go from full-time to part. The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans. A qualified separate line of business, as defined in IRC §414 (r). An employer may elect to apply the coverage tests under IRC §410 (b), and/or the minimum participation test under IRC §401 (a) (26), separately to each QSLOB. See Chapter 8 (Section VIII, Part G).

Date: January 2010

C CORPORATION CONTRIBUTION LIMITATIONS (Sec. 404 of the Code):

Example: (The Sec. 404 limit is calculated for all employer plans in the aggregate.)

| Gross Compensation 1 | $245,000.00 |

| Less Sec. 401(k) Salary Reduction | |

| Less Sec. 125 Salary Reduction | 0.00 |

| Net Compensation | |

| x 25% (or 50% if the ESOP is leveraged)2 | x 25% |

| Maximum Total Contribution to All Plans 3 | |

| Less Sec. 401(k) Salary Reduction | 0.00 |

| Less Employer Matching Contribution | |

| Less Employer Discretionary Contribution | ( 2,000.00) |

| Maximum ESOP Contribution (Sec. 404) |

- It should be noted that compensation in excess of $245,000 per individual is excluded for purposes of Sec. 404, but

not for purposes of Sec. 415. - In the case of C corporation, company contributions are limited to 25% of eligible payroll, provided that the ESOP is not leveraged. If the ESOP is leveraged, (i) the company may make contributions of up to 25% of eligible payroll to the extent that contributions are not used to make principal or interest payments on an ESOP loan, and may make contributions of up to an additional 25% of eligible payroll to the extent that such contributions are used to make principal payments on an ESOP loan or prior to the time for filing the company’s tax return, including extensions, and (ii) the company may make additional contribution to the extent that contributions are used to make interest payments on an ESOP loan (provided that not more than one-third of the contributions are allocated to highly compensated employees.)

- Note, however, that the maximum contribution is in effect limited to the maximum Annual Additions limit under Sec. 415, since Sec. 414(j) states the contributions that cannot be allocated due to Sec. 415 limits cannot be deducted.

S CORPORATION CONTRIBUTION LIMITATIONS (Sec. 404 of the Code):

Example: (The Sec. 404 limit is calculated for all employer plans in the aggregate.)

Sec. 404 | |

| Gross Compensation | $245,000.00 |

| Less Sec. 401(k) Salary Reduction | 0.00 |

| Less Sec. 125 Salary Reduction | 0.00 |

| Net Compensation | $245,000.00 |

| x 25% | x 25% |

| Maximum Total Contribution to All Plans | $ 61,250.00 |

| Less Interest Expense | ($20,000.00) |

| Less Sec. 401(k) Salary Reduction | 0.00 |

| Less Employer Matching Contribution | ( 2,000.00) |

| Less Employer Discretionary Contribution | ( 2,000.00) |

| Maximum ESOP Contribution (Sec. 404) | $ 37,250.00 |

COMPENSATION FOR ALLOCATION PURPOSES:

Unless your plan document provides otherwise, employee salary reductions under Sec. 401(k) Plans and under Sec. 125 cafeteria plans do not reduce gross compensation for ESOP allocation purposes. Thus, unless your plan specifically provides otherwise, contributions to your ESOP will be allocated among participants in proportion to gross compensation.

ANNUAL ADDITIONS LIMITATION (Sec. 415 of the Code):

Under Sec. 415 of the Code, the total Annual Additions (employer contributions, employee contributions and reallocated forfeitures) that may be allocated to a participant’s account for any given year may not exceed the lesser of $49,000 or 100 percent of the participant’s compensation. For purposes of Sec. 415, employee salary reductions under a Sec. 401(k) Plan and employee salary reductions under a Sec. 125 cafeteria plan do not reduce gross compensation. On the other hand, employee salary reductions, employer matching contributions, discretionary employer contributions, participant forfeitures, and ESOP contributions all count against the Sec. 415 limitations.

Example: (The Sec. 415 limit is calculated for each individual participant.)

Sec. 415 | |

| Gross Compensation | $245,000.00 |

| Less 401(k) Salary Reduction | 0.00 |

| Less 125 Salary Reduction | 0.00/strong> |

| Net Compensation | $245,000.00 |

| x 25% / 100% | x100% |

| Maximum Annual Additions | $245,000.00 |

| Maximum Annual Additions (EGTRRA: Lesser of $49,000 or 100% of Gross Compensation) | $ 49,000 |

| Annual Additions: | |

| Employee Sec. 401(k) Salary Reductions | $ 10,000.00 |

| Employer Sec. 401(k) Matching Contribution | 2,000.00 |

| Employer Sec. 401(k) Discretionary Contribution | 2,000.00 |

| Sec. 401(k) Forfeitures | 1,000.00 |

| ESOP Forfeitures | 0.00 |

| Total Annual Additions | $ 15,000.00 |

| Maximum Allowable ESOP Allocation | $ 34,000.00 |

| Maximum Allowable ESOP Contribution (Lesser of Sec. 404 or Sec. 415) | $ 34,000.003 |

- It should be noted that compensation in excess of $245,000 per individual is excluded for purposes of Sec. 404, but not for purposes of Sec. 415.

- Note that forfeitures of shares purchased in a leveraged transaction do not count as an Annual Addition if not more than one-third of the employer contributions are allocated to highly compensated employees.

- Although Section 404 of the Code would allow a deductible ESOP contribution of $57,250 in the case of a C-corporation and $37,250 in the case of an S corporation, Section 415 of the Code limits the actual deductible amount to $34,000.00

|

|

The Qualified Separate Line of Business (QSLOB) rules can allow employers to split its business into distinct entities for plan coverage and testing purposes In some instances, the QSLOB rules would benefit the employer’s objectives, but the requirements are complex and unfamiliar to most administrators and recordkeepers. This seminar will review the requirements associated with QSLOBs to assist practitioners in identifying situations in which QSLOBs can benefit plan operations, as well as to identify scenarios in which the rules are unlikely to be beneficial.

Topics include:

- Definition of a 'line of business'

- Identifying separate lines of business

- Determination if a SLOB is qualified

- IRS Notice requirements

- IRS QSLOB safe harbor requirements

- Applying for an IRS ruling on QSLOB status

- Coverage testing on a QSLOB basis

- Nondiscrimination testing on a QSLOB basis

There are no prerequisites and no advance preparation required for this program. However, the instructor will assume that attendees have a general familiarity with related employer, coverage testing, and nondiscrimination testing concepts, and have one year of experience.

Level: Intermediate. Instructional Delivery MethodGroup – Internet-Based

Qslob Requirements

NASBA Field of Study: Taxes

Speaker: David Schultz, J.D.Qualified Separate Line Of Business

Objectives: After attending this Web seminar, an attendee should be able to:

- Identify whether an employer might qualify as a QSLOB

- Determine whether a plan satisfies the QSLOB safe harbor

- Explain the process for obtaining an IRS ruling on QSLOB status

- Perform coverage and nondiscrimination testing on QSLOBs

How to participate

You will need a phone (speakerphone, for multiple participants sharing the Primary registrant’s authorized connection) and Internet Access. The graphics presentation and illustrations will be viewed via the Primary registrant’s Web connection, while the speaker audio portion will be via the Primary registrant’s telephone. Important Note: The user registrant must be logged in via the internet for CE purposes. Select the 'Fees' link on the right side menu of this page for more information about who is authorized to connect to the program, and for the cancellation/transfer policy.

All ownership and intellectual property rights in and relating to this website and all of its contents or any copies thereof, including but not limited to copyrights, logos, trademarks, service marks, design, text, videos, sound recordings, images, links, graphics, code, concepts and themes are owned by FIS and/or its subsidiaries (collectively 'FIS') or used under authorized license by the FIS. Any recording, reproduction, transmission, distribution, publication, performance, broadcast, hyperlink, creation of derivative works or other use in whole or in part in any manner without the prior written consent of the FIS is expressly prohibited. Without the prior written consent of the FIS, you shall not insert a hyperlink to this website or any part thereof on any other website or 'mirror' or frame this website, any part thereof, or any information or materials contained in this website on any other server, website or webpage.