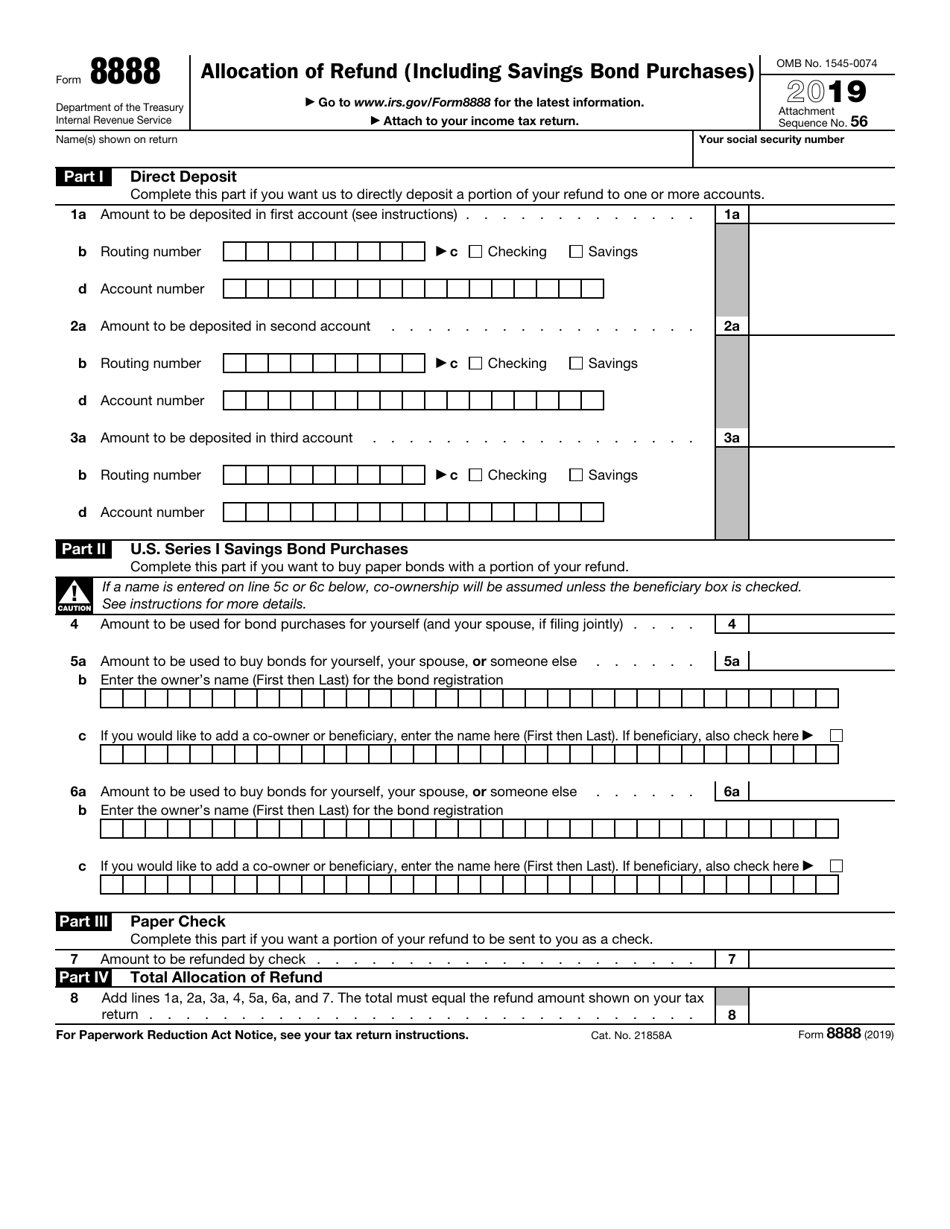

Allocation Of Refund

Posted : admin On 7/23/2022Splitting your refund is easy. You can use your tax software to do it electronically. Or, use IRS’ Form 8888, Allocation of Refund PDF (including Savings Bond Purchases) if you file a paper return. Just follow the instructions on the form. This breakdown is extremely important because the allocation of county sales and use tax on the refund and county breakdown will impact the county collections and the Sales and Use Tax Distribution for the county in which the sale has occurred. Ongoing Allocation Refunds, Washington D. As a result of the federal stimulus program (American Recovery and Reinvestment Act of 2009), agencies have new funds and incentive to make.

| Instructions: | Tips: | More Information: |

|

|

| Publ 1 | Your Rights As A Taxpayer | 2017 |

| Publ 1 | Your Rights As A Taxpayer | 2014 |

| Publ 1 | Your Rights As A Taxpayer | 2012 |

| Publ 1 | Your Rights As A Taxpayer | 2005 |

| Publ 1 | Your Rights As A Taxpayer | 2000 |

| Publ 1 | Your Rights As A Taxpayer | 1998 |

| Publ 1 | Your Rights As A Taxpayer | 1996 |

| Publ 1 (AR) | Your Rights As A Taxpayer (Arabic Version) | 2017 |

| Publ 1 (BN) | Your Rights As A Taxpayer (Bengali Version) | 2017 |

| Publ 1 (CN-T) | Your Rights As A Taxpayer (Chinese Traditional Version) | 2017 |

| Publ 1 (FA) | Your Rights As A Taxpayer (Farsi Version) | 2017 |

| Publ 1 (FR) | Your Rights As A Taxpayer (French Version) | 2017 |

| Publ 1 (GUJ) | Your Rights As A Taxpayer (Gujarati Version) | 2017 |

| Publ 1 (HT) | Your Rights As A Taxpayer (Haitian Creole Version) | 2017 |

| Publ 1 (IT) | Your Rights As A Taxpayer (Italian Version) | 2017 |

| Publ 1 (JA) | Your Rights As A Taxpayer (Japanese Version) | 2017 |

| Publ 1 (KM) | Your Rights As A Taxpayer (Khmer-Central (Cambodia) Version) | 2017 |

| Publ 1 (KO) | Your Rights As A Taxpayer (Korean Version) | 2017 |

| Publ 1 (PA) | Your Rights As A Taxpayer (Punjabi Version) | 2017 |

| Publ 1 (PL) | Your Rights As A Taxpayer (Polish Version) | 2017 |

| Publ 1 (PT) | Your Rights As A Taxpayer (Portuguese Version) | 2017 |

| Publ 1 (RU) | Your Rights As A Taxpayer (Russian Version) | 2017 |

| Publ 1 (SP) | Your Rights As A Taxpayer (Spanish Version) | 2017 |

| Publ 1 (SP) | Derechos del Contribuyente | 2014 |

| Publ 1 (SP) | Derechos del Contribuyente | 2012 |

- The Internal Revenue Service is trying to find Wisconsin 971 taxpayers who have refund checks waiting for them totaling $858,206. That's an average of $884 apiece.

- Part III Paper Check Part IV Total Allocation of Refund Information about Form 8888 and its instructions is at www.irs.gov/form8888. Attach to your income tax return. 1a 1a b c d 2a 2a b c d 3a 3a b c d 4 4 5a 5a b c 6a 6a b c 7 7 8 8 For Paperwork Reduction Act Notice, see your tax return instructions.

Allocation Refund List

Get Adobe ® Reader

(a)Nondeductibility of expenses allocable to exempt income.

Irs Direct Deposit

(1) No amount shall be allowed as a deduction under any provision of the Code for any expense or amount which is otherwise allowable as a deduction and which is allocable to a class or classes of exempt income other than a class or classes of exempt interest income.

(2) No amount shall be allowed as a deduction under section 212 (relating to expenses for production of income) for any expense or amount which is otherwise allowable as a deduction and which is allocable to a class or classes of exempt interest income.

(b)Exempt income and nonexempt income.

(1) As used in this section, the term class of exempt income means any class of income (whether or not any amount of income of such class is received or accrued) wholly exempt from the taxes imposed by Subtitle A of the Code. For purposes of this section, a class of income which is considered as wholly exempt from the taxes imposed by subtitle A includes any class of income which is:

(i) Wholly excluded from gross income under any provision of Subtitle A, or

(ii) Wholly exempt from the taxes imposed by Subtitle A under the provisions of any other law.

(2) As used in this section the term nonexempt income means any income which is required to be included in gross income.

(c)Allocation of expenses to a class or classes of exempt income. Expenses and amounts otherwise allowable which are directly allocable to any class or classes of exempt income shall be allocated thereto; and expenses and amounts directly allocable to any class or classes of nonexempt income shall be allocated thereto. If an expense or amount otherwise allowable is indirectly allocable to both a class of nonexempt income and a class of exempt income, a reasonable proportion thereof determined in the light of all the facts and circumstances in each case shall be allocated to each.

(d)Statement of classes of exempt income; records.

Irs Allocation Of Refund Form

(1) A taxpayer receiving any class of exempt income or holding any property or engaging in any activity the income from which is exempt shall submit with his return as a part thereof an itemized statement, in detail, showing (i) the amount of each class of exempt income, and (ii) the amount of expenses and amounts otherwise allowable allocated to each such class (the amount allocated by apportionment being shown separately) as required by paragraph (c) of this section. If an item is apportioned between a class of exempt income and a class of nonexempt income, the statement shall show the basis of the apportionment. Such statement shall also recite that each deduction claimed in the return is not in any way attributable to a class of exempt income.

888 Allocation Of Refund

(2) The taxpayer shall keep such records as will enable him to make the allocations required by this section. See section 6001 and the regulations thereunder.